⬇ Download the eBook: Dubai tops global foreign direct investment lists in 2024: Key sources driving its continued stability

Table of contents

Dubai is ceaseless in its drive to become one of the world’s leading financial hubs that provide a thriving field for capital inflows and business expansion. Recent data from established monitoring platforms, such as fDi Markets and Dubai FDI Monitor, indicate that the city has successfully attracted global companies, institutional investors, and entrepreneurs from a wide range of sectors. These segments include high-tech industries like AI and fintech, as well as labour-intensive, service-oriented enterprises.

The emirate’s financial ecosystem, greatly influenced by government-backed strategies, has experienced an exceptional level of participation from foreign investors. The rise in greenfield investments, venture capital inflows, and cross-border mergers further reinforces its role as a top-tier investment epicentre.

This e-book strives to understand the fundamental factors behind the city’s significant development in foreign direct investments. It also examines its rising appeal to global investors and provides insights into how entrepreneurs wanting to start a business in Dubai can leverage its dynamic financial expanse for uptrend progress.

Since the COVID-19 pandemic began, Dubai has been persistently combating the potential repercussions of an economic downturn by proactively initiating its recovery phase. The emirate has leveraged every resource available (e.g., cross-sector technological adoption) to turn global challenges into new growth avenues. This foresight has helped turn Dubai into one of the top FDI cities in the world, with a consistent rise in key investment metrics year after year.

According to the fDi Markets findings (published by Financial Times), Dubai ranks first globally in about 180 cities for greenfield FDI projects. It held this position for the fourth successive year. The emirate recorded 260 projects in 2020, increasing by 138% to 618 in 2021, then rising by 35% to 837 in 2022. In 2023, projects grew by another 28% to reach 1,070 before increasing by 4% in 2024 to 1,117. This upward trajectory undoubtedly improves Dubai’s investment and business environment even further.

Greenfield FDI capital inflows followed a similar pattern, rising by 18% from AED22 billion in 2020 to AED26 billion in 2021. A surge of 81% in 2022 brought inflows to AED47 billion before a temporary 17% decline to AED39 billion in 2023. The momentum resumed in 2024 with a 33% increase, reaching AED52 billion — the highest recorded value.

This increased activity helps to reinforce the city’s regional (PAN MENA) power as the No. 1 platform for greenfield FDI capital. On the international stage, Dubai ranks fourth, following Phoenix, US (#1), Singapore (#2), and Tokyo, Japan (#3).

Announced FDI projects also showed remarkable growth, increasing by 31% from 470 in 2020 to 618 in 2021. The number nearly doubled in 2022, with a 92% surge to 1,187. Growth continued in 2023 with a 39% rise to 1,650 projects, culminating in a record-breaking 1,823 projects in 2024, reflecting a further 10% increase. This constant climb reaffirms the city’s economic resilience and attractiveness for investors exploring efficient ways about how to start a business in Dubai.

In addition to its lucrative capital investments, Dubai is host to a dynamic corporate space that is replete with a highly skilled, diversified talent pool. By 2024, an estimated 58,680 new jobs were generated through FDI, marking a 51% increase from 2023. The values provide a glimpse into how the emirate has actively developed various avenues to build a successful workforce. This, in turn, makes it even more appealing as a global economic centre.

It’s worth noting that the city leads in greenfield FDI capital and jobs throughout the MEA region.

Also read: Dubai’s FDI hits record in 2024: How will this impact the financial sector?

From 2020 to 2024, Dubai has been among the biggest nations for global investment ventures as it focuses on high-value industries and creating an innovation-driven ecosystem. The consistent influx of capital and projects highlights its importance in global trade, finance, and technology.

In technology, specifically, Dubai has built a strong market for both high- and medium-tech investments. Over the past few years, the proportion of foreign direct investments in these sectors has shown impressive trends, with notable peaks: 57.66% in 2020, rising to an all-time high of 66.02% in 2021. While there has been a slight adjustment in the following years (i.e., 63.18% in 2022, 58.18% in 2023, and 53.37% in 2024), technology-driven industries remain central to the city’s all-embracing, thorough economic plan.

This strategic focus has beckoned global entrepreneurs wanting to set up their businesses in Dubai. As a result, the emirate has become the top location for global headquarters FDI projects for three straight years since 2022. It recorded 50 HQ FDI projects last year.

The city’s ability to draw world-class investors is also evident in the leading source countries contributing to its FDI growth.

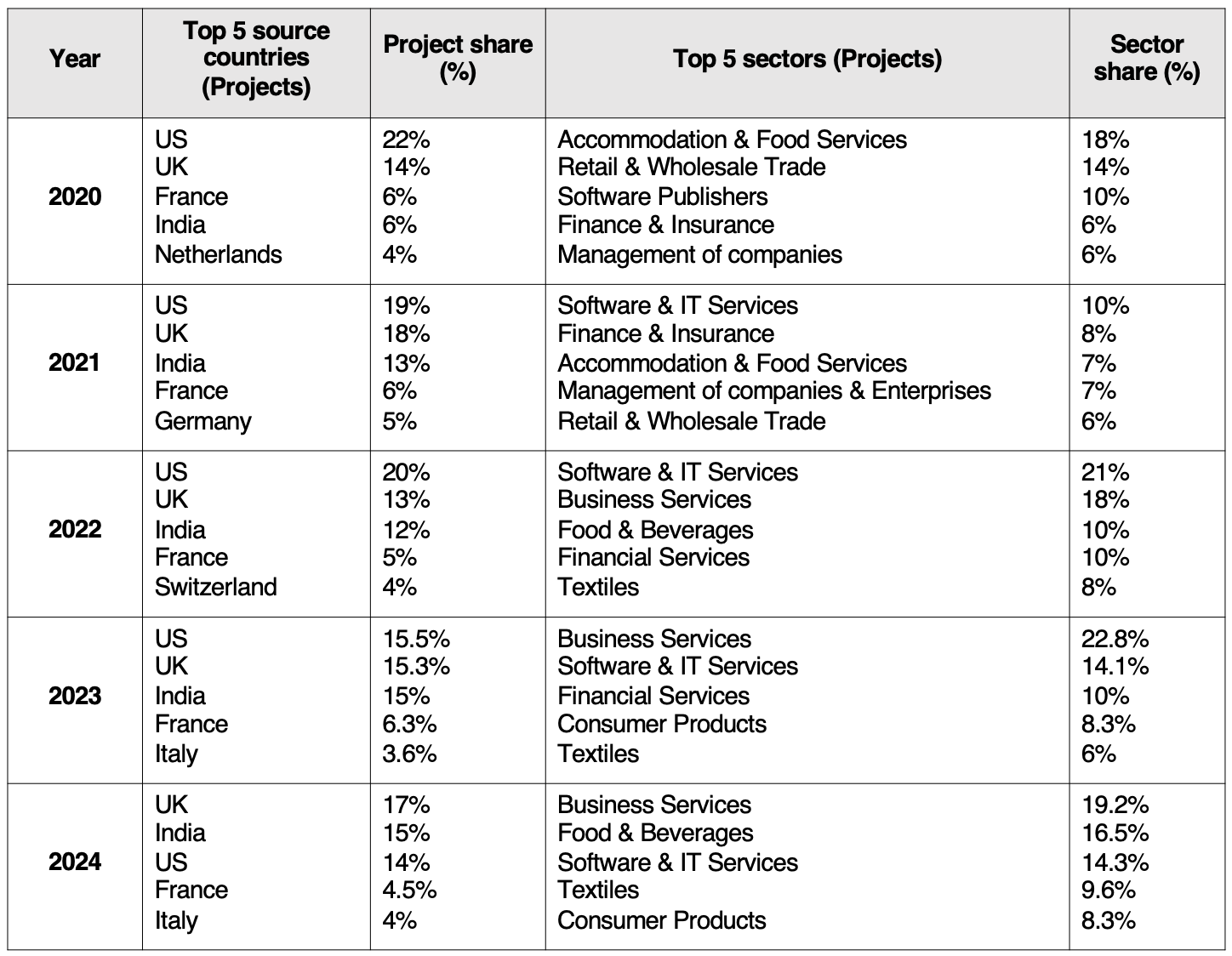

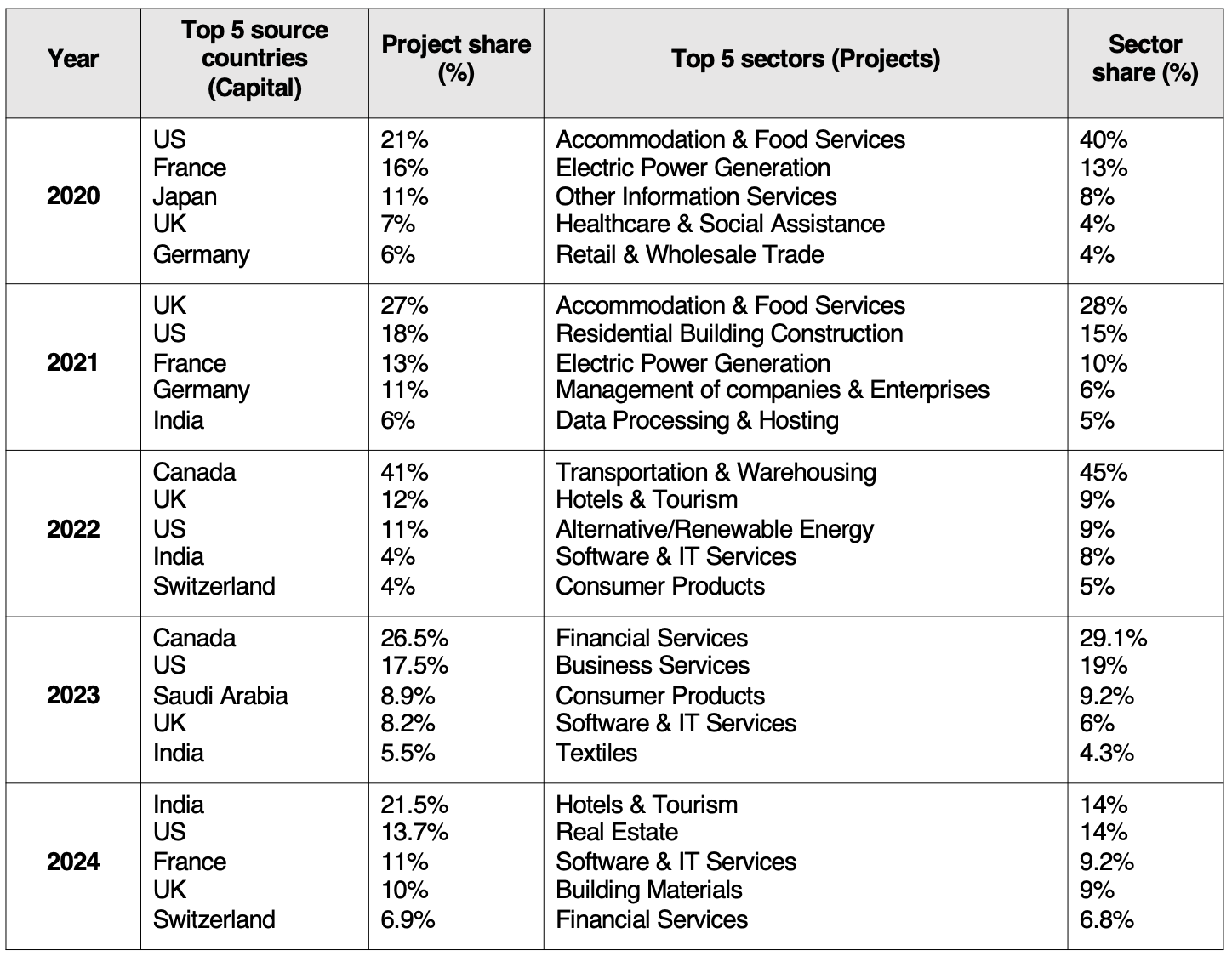

Dubai has continually attracted FDI projects, with Business Services, Software & IT Services, and Food & Beverages emerging as dominant sectors. The US, UK, and India are the top contributors to these investments, highlighting Dubai’s appeal for international business expansion.

The city has also maintained a steady flow of FDI capital across different sectors. The top source countries for capital have evolved over the years, with strong contributions from the US, UK, Canada, India, and France. Notably, Financial Services, Business Services, Software & IT, and Accommodation & Food Services are among the leading sectors defining Dubai’s investment space.

Also read: The top sources boosting Dubai’s 2024 FDI growth: What global investors and firms need to know

The venture capital (VC) market in the Middle East is highly competitive, with the UAE leading in both deal volume and funding. MAGNiTT’s MENA Venture Investment Premium Report reveals that the region secured approximately AED5 billion across 461 deals, with the UAE accounting for 188 transactions — a 9% YoY increase. This development displays the nation’s investment field, which undoubtedly makes it a top space for global capital ventures.

Home to over 427 VC funds, the emirate is persistent in its efforts to build a profitable operating ground for business and investment activities. Hence, investors and entrepreneurs exploring opportunities to start a business in Dubai can benefit from various funding pathways and strategic alliances with key decision-makers.

Undeniably, the city’s ability to draw high-value investors (i.e., VCs) is reflected in its diverse FDI inflows, further improving its global financial sphere.

Building on this narrative, Dubai FDI Monitor was introduced in 2018 and tracks all investment inflows, including New Forms of Investment (NFIs), which comprise joint ventures, licensing, franchising, and subcontracting. These non-equity investments reflect the city’s economic maturity and provide diverse market entry options for multinational firms. In 2021, the VC-Backed FDI category was introduced.

In 2024, the emirate recorded immense growth across various FDI types. Greenfield FDI projects increased by 0.2%, while NFIs surged by 23%. Reinvestments nearly doubled (+98%), VC-backed FDI expanded by 39%, and Mergers & Acquisitions (M&A) activity rose by 8%. This upward trend cements Dubai’s position as a global investment hub, making setting up a business in Dubai a highly attractive prospect for international investors.

The city’s venture capital ecosystem and FDI success display its ability to attract high-value investments. As doing business in Dubai becomes more seamless through strategic policies and investor-friendly reforms, the city continues to establish itself as a financial capital worldwide.

The 2024 edition of fDi Intelligence’s Global Free Zone Awards has recognised Dubai Multi Commodities Centre (DMCC) and Dubai World Trade Centre Authority (DWTC) as leading knowledge zones. These zones are crucial in attracting foreign direct investments and cultivating economic diversification.

DMCC, home to over 24,000 companies, specialises in high-value sectors, including precious stones, energy, gaming, artificial intelligence, and blockchain. In 2023, it welcomed 2,692 new companies, building on 2022’s record of 3,049 new businesses. Remarkably, DMCC accounted for 15% of Dubai’s total FDI projects over the past two years.

In line with this, DWTC remains a top choice for multinational firms as it continues to offer an advanced ecosystem for fintech, blockchain, and AI. It has streamlined operations with an online tenant portal, promoting transparency and efficiency. The centre has also aligned with the UAE’s financial governance standards, contributing to its removal from the Financial Action Task Force’s grey list.

The Dubai International Financial Centre (DIFC) also maintains its repute as a global financial space. Identified by fDi Intelligence as the world’s top free zone for greenfield FDI projects, DIFC attracted 116 projects valued at over AED1 billion in 2023, about a 50% increase since 2021. Home to over 6,000 companies, including 1,081 fintech and innovation firms, DIFC also recorded a surge in assets under management from AED1 trillion to AED2 billion.

Dubai’s strong FDI ranking internationally is also credited to its visionary leadership and pro-business policies. The government’s foresight, coupled with ambitious economic reforms, has paved the way for a dynamic, diversified economy. Comprehensive projects such as the Dubai Economic Agenda (D33) have created a business-friendly environment that makes it attractive for global investors eager to do business in the city.

Furthermore, the UAE’s National Investment Strategy 2031 aims to increase FDI stock to AED2.2 trillion and raise annual inflows to AED240 billion. The strategy focuses on five core sectors: (1) industry, (2) financial services, (3) transport and logistics, (4) renewable energy, and (5) telecommunications. It introduces 12 programs and 30 initiatives, including the Financial Sector Development Programme and the Partner Countries Gateway Programme, to enhance investor confidence and streamline business set-up processes.

Dubai’s strategic government-backed initiatives are also bolstering investment across key sectors. The Dubai Future District Fund (DFDF), backed by the Dubai Future Foundation and DIFC, has made 29 investments in venture capital and direct projects, reinforcing the emirate’s role as a global tech and innovation platform. The DFDF supports major initiatives like the Dubai Sandbox Initiative, aimed at easing regulatory barriers for start-ups, and the Dubai Research, Development, and Innovation Programme, which drives technological advancement.

With these comprehensive free zone policies and government-backed investment strategies, Dubai is cementing its stronghold as a global leader in economic development, innovation, and foreign investment attraction.

Dubai’s FDI growth reinforces its repute as a global business hub, offering foreign firms a stable and dynamic environment for business set-up and growth. The increasing capital inflows, strategic government policies, and sectoral diversification create new opportunities for companies worldwide to establish a strong regional presence. As investment is on its upward trajectory, entrepreneurs looking to do business in Dubai can benefit from enhanced market access, improved infrastructure, and a competitive corporate expanse.

Don’t forget to share this post!

We use cookies to enhance your experience on our website. If you continue using this website, we assume that you agree with these. Learn more.