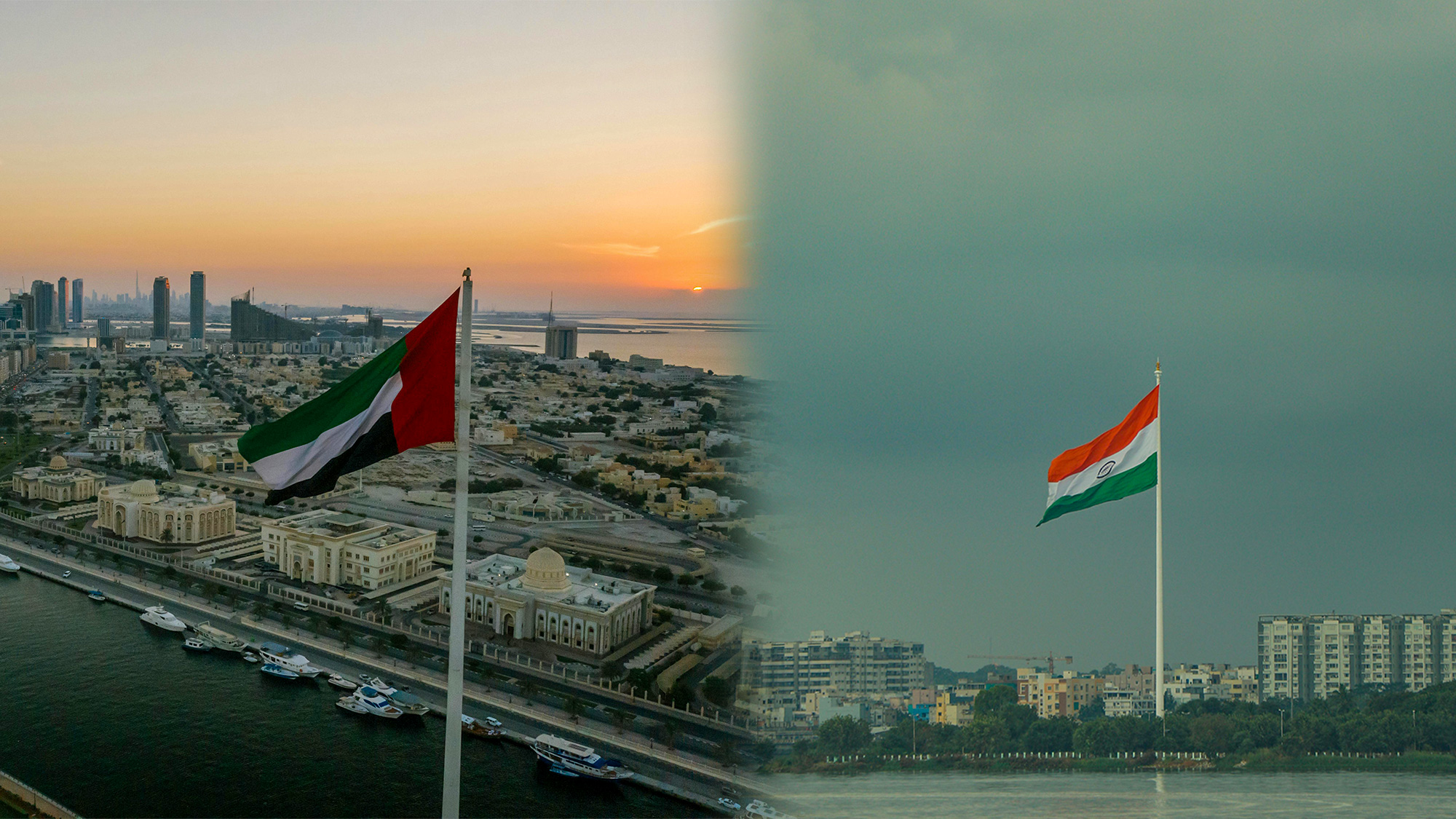

Speaker spotlight: Prakash Ramaseshan on ‘The UAE-India Investment Corridor: Trends, Opportunities, and Growth Prospects in 2025’

India has made significant progress in the digital sector, driven by government initiatives such as Digital India and Startup India. These programs have created opportunities for innovation, entrepreneurship, and digital empowerment. However, there are still a few gaps that need to be addressed. A considerable digital divide persists in rural India, with over 40% of the rural population lacking reliable internet access. Additionally, infrastructure bottlenecks and data privacy concerns continue to challenge digital trust.

Meanwhile, the UAE is persistently building a digital-first economy, as evidenced by several high-profile trade exhibitions (e.g., GITEX and Dubai AI Week) and national-level initiatives (e.g., the UAE Digital Economy Strategy) launched. These efforts also underlined the country’s goal of guaranteeing a technology ecosystem with strong cybersecurity foundations. It’s worth noting that many of these factors are now being addressed at the ecosystem level — insights that will be explored in our upcoming virtual roundtable on the UAE investment landscape.

India’s developing partnership with the UAE is the result of structured efforts from both public and private organisations. Accordingly, corporate collaborations are rising, with several UAE-based companies — often supported by sovereign wealth funds or influential family offices — investing in Indian innovations. These partnerships primarily focus on co-developing infrastructure in key sectors such as telecommunications, energy, and AI.

For Indian tech startups and innovators, working with family offices or sovereign-backed investors in the UAE can be a game-changer. Distinguished venture capitalists, institutional investors, family offices, and even angel investors undeniably provide financial support, regulatory guidance, and access to government projects.

In turn, Indian companies bring technical skills, user-focused solutions, and access to larger audiences. This synergy helps create scalable solutions to shared challenges, such as rural connectivity, secure data systems, and accessible technology. These themes will be outlined in detail in our upcoming webinar on 29 April 2025.

In our upcoming live discussion session, Prakash Ramaseshan, Advisor at The Private Office of Sheikh Saeed bin Ahmed Al Maktoum, will speak on ‘The UAE-India Investment Corridor: Trends, Opportunities, and Growth Prospects in 2025.’ In his presentation, Ramaseshan will break down the data surrounding investment flows between the UAE and India. This will be especially relevant for founders and investors seeking to tap into the UAE’s capital-rich, innovation-focused environment.

With 30 years of experience in investment strategy and fund management, Ramaseshan brings deep market knowledge into fund structuring, regulatory alignment, and growth-stage capital mobilisation between India and the UAE. Notably, he will detail how tech startups from India can benefit from:

Ramaseshan will also describe how Indian companies can tap into this ecosystem to:

For founders keen on starting a business in the UAE and specifically Dubai, his upcoming session will offer strategic guidance on long-term, scalable partnerships. Whether it’s co-developing sovereign-compliant data systems or expanding digital inclusion models, Ramaseshan’s session will reveal how innovative Indian companies can methodically maximise the country’s fertile launching ground.

If you’re looking to set up a business in the UAE and specifically Dubai, this is the data-rich briefing you can’t afford to miss.

As the UAE and India strengthen their digital and economic partnership, the investment corridor is at a key moment. Strategic cooperation, government support, and the readiness of both markets are coming together to launch new innovations. For India-based entrepreneurs eyeing international growth, starting a business in the UAE, particularly in Dubai, offers clear regulations, high digital connectivity, and access to wider MENA markets.

The themes explored in this article (which is part of a series) align with the future dialogue that will be covered by global experts in our upcoming online discussion event titled ‘Mapping UAE Investment in 2025: Family Offices, Startups, and Growth Opportunities.’ In our next post, we will look at the influential role of family offices in the UAE, along with the impact on entrepreneurs eager to start a business in the market.

Don’t forget to share this post!

We use cookies to enhance your experience on our website. If you continue using this website, we assume that you agree with these. Learn more.