The UAE has been ranked 10th worldwide in the Global Soft Power Index 2025, according to a report by Brand Finance. This index evaluates 193 countries based on insights from 173,000 civil society members, policymakers, and business leaders. Impressively, the value of the UAE’s Nation Brand grew from AED3.60 trillion to AED4.40 trillion in 2025. The UAE excelled in several significant categories, clinching fourth place in ‘Future Growth Potential,’ and ninth in ‘Advanced Technology and Innovation.’

A key factor in this global recognition is Dubai’s forward-thinking and pro-business initiatives — designed to bolster investor appeal. As a result, recent data reveals the emirate is among the world’s top destinations for foreign direct investments.

This article is part of a series analysing global Dubai’s FDI strength in 2024. In this edition, we focus on the leading countries and industries driving foreign investments into the emirate.

Dubai has proven its excellent strength in bringing in FDI, maintaining a steady upward trajectory from 2020 to 2024. According to fDi Markets, it has been one of the top global destinations for greenfield FDI projects for four years in a row.

When comparing FDI capital values between 2020 and 2024, the emirate experienced a 113% increase. Furthermore, greenfield FDI projects rose by 146% during this period, amping up its already strong economic appeal for investors interested in doing business in Dubai. These developments have significantly contributed to job creation, which has increased by 220% over the past four years.

Among the industries that drew FDI, the top five accounted for 53% of the total estimated capital flows into Dubai. Additionally, the top five sectors by the number of FDI projects made up 68% of the total announced projects. Hotels and tourism, along with real estate, each brought in 14% of the FDI capital. They were followed by software and IT services at 9.2%, building materials at 9%, and financial services at 6.8%.

In terms of the number of projects, business services led with 19.2%, followed by food and beverages at 16.5%, software and IT services at 14.3%, textiles at 9.6%, and consumer products at 8.3%.

The impact of technology levels in Dubai’s FDI landscape is also notable. According to data from Dubai FDI Monitor, low-tech projects in the emirate dominate in volume, with 850 projects attracting AED27.54 billion in FDI and generating 32,436 jobs. At the same time, high-tech projects, though fewer (434 projects), secured a substantial AED12.5 billion, thus reflecting strong investor confidence in emerging sectors.

Medium-tech projects accounted for 539 projects, with AED9.2 billion in capital and 13,532 jobs, positioning them as a middle ground between labour-intensive and capital-intensive ventures. These distributions affirm Dubai’s ability to yield investment across multiple technology levels, ensuring sustained economic expansion, job creation, and a thriving innovation ecosystem.

By 2031, Dubai foresees doubling its FDI inflows to AED240 billion from AED112 billion in 2023. This growth strategy includes reinforcing its position as a global investment destination through regulatory enhancements, along with streamlined procedures for setting up a business in Dubai, to attract high-value investments.

The Middle East’s venture investment market has solidified its landscape for investors, with the UAE leading the region in deal volume and funding activity. As per MAGNiTT’s FY2024 MENA Venture Investment Premium Report, the geographical expanse secured roughly AED5 billion across 461 deals. The UAE stood out with 188 deals, which accounts for a 9% increase from the previous year. This growth provides a glimpse into the UAE’s dominant role in drawing foreign investments. A strong VC environment signals a thriving innovation field, bolstering investor confidence.

Dubai, in particular, has become a top destination for global VCs backing start-ups. The city hosts over 427 VC funds, building a vibrant environment for those eager to set up a business. Investors and entrepreneurs benefit from the nearly AED1 billion Future District Fund, which is designed to strategically address various business sizes and growth stages.

The Dubai Future District Fund, backed by the Dubai Future Foundation and DIFC, also enhances investor confidence through structured financial support. These government-led initiatives undeniably reduce regulatory barriers, making it easier for firms to scale and attract sustained FDI inflows.

Venture investment significantly influences broader FDI uptrends, defining the investment field across diverse industries. Dubai’s rise in global FDI metrics in 2024 is attributed to several investment types, including New Forms of Investments (NFIs), which grew by 23%, and reinvestments, which surged by 98% in 2024. Additionally, VC-backed FDI increased by 39% while M&As climbed by 8% — further demonstrating strong corporate interest in strategic partnerships.

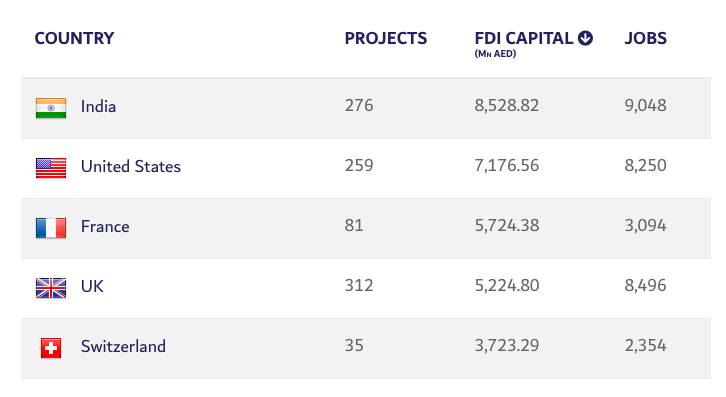

The Dubai FDI Monitor revealed that in 2024, the top five source countries for FDI capital into Dubai were India, the United States, and major European economies (i.e., France, the United Kingdom, and Switzerland).

Source: Dubai FDI Monitor

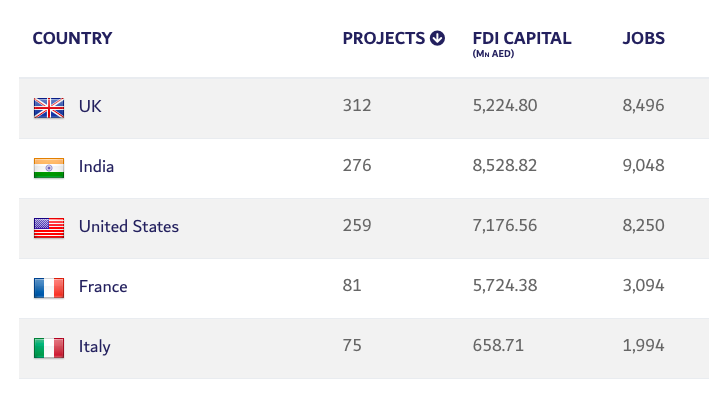

In terms of the total number of announced FDI projects in Dubai, the leading source countries were the United Kingdom, India, the United States, France, and Italy.

Source: Dubai FDI Monitor

Dubai has maintained its rising progress in terms of bringing in foreign direct investments for the past four years or so. As such, international businesses seeking to tap into the lucrative market will find setting up a business in Dubai a strategic move. The emirate’s ingenious approach to technology (i.e., business-friendly policies) and its growing start-up ecosystem present ample prospects for firms to scale. With a combination of low-tech, medium-tech, and high-tech FDI inflows, investors can indeed access diverse sectors that are well-suited to their different business needs.

Don’t forget to share this post!

We use cookies to enhance your experience on our website. If you continue using this website, we assume that you agree with these. Learn more.

Dubai’s remarkable surge in foreign direct investment (FDI) underscores its growing appeal as a global business hub. The 33.2% increase in FDI capital in 2024, reaching AED52.3 billion, highlights the emirate’s robust economic strategies and investor-friendly environment. Notably, India has emerged as the top source country, contributing 21.5% of the total FDI capital, followed by the United States, France, the United Kingdom, and Switzerland. This diverse investment landscape reflects Dubai’s successful efforts in attracting a wide range of industries and solidifying its position as a premier destination for international business expansion.