⬇ Download the eBook: Starting a business in Dubai in 2025: A practical guide for first-time entrepreneurs

Table of contents

According to The Venture Pulse Q4 2024 by KPMG Private Enterprise, companies backed by venture capital raised an impressive AED 398.83 billion in over 7,000 deals in the last quarter of 2024. This is the highest amount raised in nearly two years, mainly due to rapid growth and investor enthusiasm in artificial intelligence. The momentum has also led to a surge in unicorns (start-ups valued at over AED 3.60 billion), with 110 new unicorns emerging globally last year.

Focusing on the Middle East, the region has become a capital for innovation and entrepreneurship, with the United Arab Emirates leading the way. In 2024, the nation accounted for more than 51% of all active tech startups in the MENA region, up from 43% the year before. This growth reflects the country’s bold efforts to attract entrepreneurs and global investors through favourable regulatory systems, a growing VC environment, and access to international markets.

At the centre of this change is Dubai. By the end of 2023, Dubai’s start-up ecosystem alone was valued at over AED84 billion. The city ranked first in the Gulf and second in the MENA region for ecosystem value and an impressive 18th globally among emerging ecosystems, based on data from Startup Genome’s Global Startup Ecosystem Report 2024. Notably, Dubai scored a perfect 10/10 in early-stage funding and is home to five unicorns, making it a standout performer in the region. With strong investor activity, deepening global market reach, and powerful institutional support from platforms like in5, Dubai is positioned as a magnet for scalable, tech-driven ventures.

This article explores the core factors that make the emirate a compelling destination for young founders and investors. It covers funding options, policies, talent, and key industries. It also provides basic guidance to those wondering how to start a business in Dubai.

Dubai continues to rise as a global player in the start-up world, gaining international recognition for its rapidly maturing entrepreneurial environment. According to StartupBlink’s 2025 Global Start-up Ecosystem Index, Dubai has surged six spots to rank 44th globally. This increase represents a 33% YoY climb, which is one of the highest growth rates among the world’s top 50 ecosystems — includes San Francisco (1st), New York (2nd), and London (3rd).

Remarkably, the emirate remains the top-ranked city in the Arab League, reaffirming its leadership in the MENA region. Over the past six years, the city has climbed an extraordinary 95 positions, a reflection of its robust infrastructure, strategic investment in innovation, and increasing global relevance for start-ups.

Complementing these findings, Startup Genome’s report further stresses Dubai’s remarkable progress. In the Emerging Ecosystems Ranking, which assesses the top 100 early-stage start-up environments globally, Dubai ranks 18th, placing it firmly among the most promising ecosystems worldwide. The city also ranks 1st in the MENA region and 5th across Asia, marking its dominance in regional entrepreneurship and growing international competitiveness.

Dubai’s ecosystem was particularly distinguished by its perfect 10/10 funding score, which measures the strength of early-stage investment through angel investors, venture capital, and public funding initiatives. A report also reveals that between H2 2021 and 2023, Dubai start-ups raised AED4.74 billion in early-stage funding, placing it among the leading emerging ecosystems globally by funding amount.

Other key metrics from the 2024 Global Startup Ecosystem insight include:

Dubai’s overall standing in Startup Genome’s analysis affirms that it is an ideal environment for execution-driven ventures such as fintech, SaaS, logistics, and consumer tech. The collective data from prominent global reports illustrate the city’s rapid rise and growing influence as a start-up hub, which are undeniably important factors for entrepreneurs considering doing business in Dubai.

Also read: Why Dubai remains a top choice for start-up founders in 2025

Dubai’s growth as a global start-up hub hasn’t happened by chance. A key driver behind this rise is consistent, targeted support from the government through funding, infrastructure, and business-friendly policies. This combination continues to attract entrepreneurs from around the world, including from countries like Singapore, the United Kingdom, and Kazakhstan.

One of the clearest examples of this support is the Dubai Future District Fund. Backed by the Dubai International Financial Centre and the Dubai Future Foundation, the Fund committed over AED6 billion in capital in 2024 alone and supported more than 190 start-ups. Its efforts go beyond direct investment, with 12 Fund of Funds initiatives aimed at advancing key sectors outlined in the Dubai Economic Agenda.

According to the DFDF, these achievements highlight Dubai’s commitment to building a digital economy rooted in innovation, connectivity, and collaboration. The Fund has also made itself a bridge between public and private stakeholders — linking founders, investors, regulators, and global markets. For founders and investors alike, this makes doing business in Dubai more accessible, scalable, and future-ready.

Financial backing is, of course, only part of the story. In 2025, the government introduced a major policy shift designed to make it even easier to start a business in Dubai. Under Executive Council Resolution No. (11) of 2025, companies operating in free zones can now legally do business on the Dubai mainland without the need for dual licensing or relocation.

Issued by H.H. Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai and Chairman of The Executive Council, this move significantly reduces regulatory complexity while expanding market reach. This, in turn, allows businesses to retain the perks of free zone operations while accessing the broader UAE economy.

The city has also introduced a variety of investor-friendly reforms in recent years that further level the playing field for companies across scales. The introduction of the 15% Domestic Minimum Top-up Tax in January 2025 for multinationals with revenues exceeding €750 million, reflects the UAE’s commitment to global tax standards without compromising its entrepreneurial appeal.

It’s also worth bringing to notice the strategic role of Dubai SME and the Dubai Chamber of Digital Economy. Last year, Dubai SME provided support to over 48,000 Emirati business leaders and contributed to the development of 18,429 local companies.

In parallel, the Chamber of Digital Economy backed the setting up and expansion of 1,210 start-up firms in the digital technology sector. Initiatives such as ‘Create Apps in Dubai’ trained 1,333 Emiratis in mobile app development in 2024. These initiatives emphasise the Chamber’s strategic push to triple the number of app developers in the city by 2025 and back 100 new national tech projects.

The Chamber also hosted 21 events in 2024 and led 20 international exhibitions and roadshows to connect the emirate with global innovation hubs, subsequently making it attractive for investors and innovators keen on doing business in Dubai.

All of these policies further emphasise the emirate’s progressive approach to governance. They also reinforce the city’s commitment to a fair, transparent, and globally integrated corporate field. Subsequently, start-ups are presented with a significant edge when doing business in Dubai.

Also read: What makes Dubai attractive to start-ups and SMBs in 2025: Top reasons explained

Entrepreneurs looking to start a business in Dubai may consider focusing on sectors that match global trends and regional needs. The most active verticals include fintech, e-commerce, healthcare, renewable energy, AI, and cybersecurity. Fintech alone commands over 30% of all start-up funding in Dubai, totalling AED4.60 billion since 2017. The software and data field has also seen the top three Dubai-based start-ups raise over AED4.50 billion in funding.

According to Tracxn’s Q1 2025 UAE Tech Funding Report, UAE-based tech start-ups raised an astounding AED3.20 billion in Q1 2025 — a 194% surge over the previous quarter and an 865% YoY increase. This growth was largely propelled by late-stage funding and mega-deals exceeding AED367 million. Notably, Dubai-based start-ups accounted for 96% of this total, underscoring the city’s unrivalled dominance in the region’s tech funding landscape.

Three sectors emerged as the most lucrative:

Two Dubai-based companies, Vista Global and Tabby, raised over AED3.60 billion each in late-stage rounds. This echoes the city’s prominence as a magnet for scale-ready ventures.

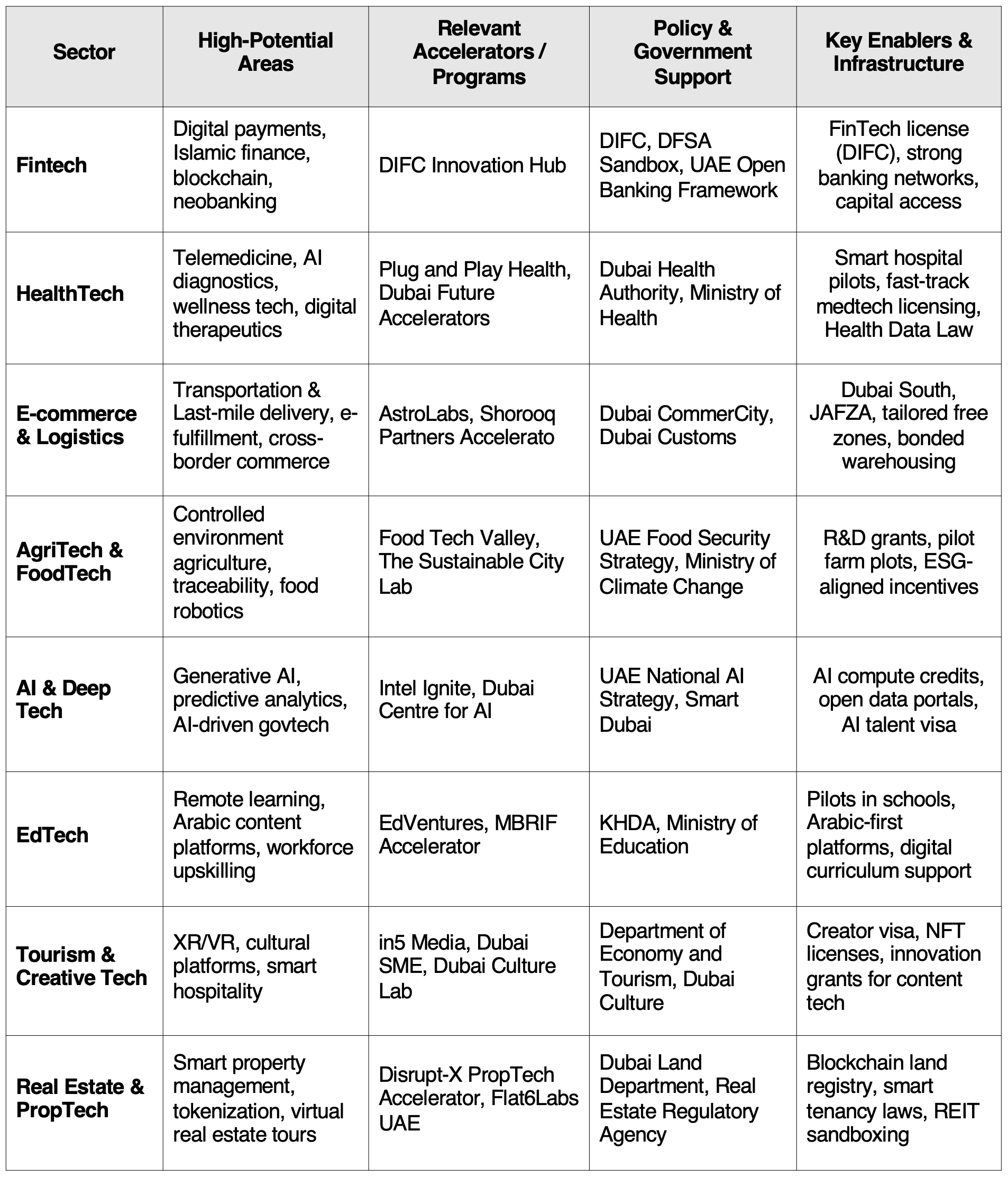

The emirate has firmly established itself as the UAE’s leading hub for innovation and venture capital, yielding 96% of all start-up funding in the country during the first quarter of 2025. These funding patterns reflect sectors where Dubai offers a unique mix of policy support, investor interest, and growth infrastructure. Below is a breakdown of these opportunity areas and the ecosystem enablers accelerating them.

Start-ups in Dubai benefit from regular access to global stages. Flagship events like GITEX Technology Week — the region’s largest and most international tech showcase, drawing over 200,000 attendees and 6,500+ exhibitors — provide critical exposure for founders seeking capital, partnerships, and scale.

Sector-specific platforms further deepen ecosystem connections, such as:

Also read: Venture capital firms and scale-ups exemplify the value of starting a business in Dubai

According to the 2024 Savills Dynamic Wealth Indices, Dubai is home to 81,200 millionaires, 237 centimillionaires, and 20 billionaires. This makes it one of the fastest-growing wealth centres globally, with a 102% increase in millionaires in the past 10 years alone.

This concentration of private wealth is arguably a catalyst for innovation, as HNWIs often double as angel investors, venture capitalists, early adopters or strategic partners. They are intrinsically important in fuelling the growth of early-stage ventures. As Dubai’s millionaire population expands, so too does the pool of capital available to fund promising start-ups and scale-ups.

Complementing this wealth density is a rising investor-to-start-up ratio. As outlined in the 2025 MENA Early Stage Handbook by Clearworld, the number of active investors in MENA surpassed the number of new start-ups for the first time in 2024. In this new paradigm, investors are proactively hunting for founders with compelling business models. For anyone starting a business in Dubai, this represents an unprecedented opportunity to attract funding — particularly if the venture is aligned with national priorities like fintech, health tech, or green tech.

Dubai’s venture capital ecosystem has turned from passive capital providers to active proponents of homegrown innovation. Today, local VC firms are backing a wide range of businesses that operate in fields such as digital finance, logistics, and health-tech. Here’s a look at some of the key players and the kinds of companies they support:

One standout example is Middle East Venture Partners, a Dubai-based VC that has led a major funding round for a local logistics and e-commerce enablement platform. MEVP’s investment in the company underscores a clear thesis on digitising operational bottlenecks in a region where logistics and fulfilment remain key to e-commerce scalability. MEVP typically invests between AED3.60 million and AED36.70 million, and the start-up fits its playbook of tech-enabled scale-ups with regional relevance.

Another prominent Dubai-headquartered VC firm is Global Ventures. This firm backs a fintech company that provides seamless personal and business payment solutions. The funding helped support the company’s cross-border expansion and compliance upgrades, thereby complementing Global Ventures’ strategy to invest in B2B fintech solutions with strong fundamentals and regional scale potential. The VC company typically invests between AED3.6 million and AED73.45 million, making this firm a compelling fit due to the revenue-generating, compliance-ready B2B fintech model it supports.

A third strong example is VentureSouq, which backed the UAE’s leading Buy Now, Pay Later (BNPL) platform in its early-stage rounds. VentureSouq’s focus on fintech innovation matched the company’s vision of offering ethical, interest-free credit alternatives — an increasingly attractive model as consumer credit tightens. The investment is undeOniably strategic, as the company has since raised over AED1.28 billion in cumulative funding. The start-up has grown to become a unicorn and has since expanded into Saudi Arabia and Kuwait, becoming the region’s BNPL benchmark.

These examples show how local VCs are integral in reinforcing the appeal and ease of doing business in Dubai. In addition to private VC firms, Dubai’s start-up environment also benefits from a diverse range of capital providers. Sovereign wealth funds like the Investment Corporation of Dubai are influential in scaling high-impact ventures. Local family offices and semi-government institutions are also increasingly participating in early- and growth-stage funding rounds.

This mix of public and private capital ensures that promising businesses have access to both patient capital and high-growth opportunities — a combination rare in emerging ecosystems.

Start-ups in the emirate are attracting local venture capital as well as experienced investors who see the city as a place to grow regionally and internationally.

A compelling example is Qashio, a Dubai-headquartered B2B spend management platform that raised AED72.71 million in a hybrid equity and non-equity round in early 2025. After achieving profitability in Q1 2025 with over AED4.40 million in net income, the company secured additional funding to support expansion into Saudi Arabia and Europe — and to strengthen compliance capabilities. This development, therefore, helped make it a large B2B fintech loyalty ecosystem in MENA.

Rocketship.vc, a Silicon Valley VC establishment known for supporting data-driven companies, led this funding round. Other investors included MoreThan Capital, an early-growth VC firm from Luxembourg, as well as local family offices and banks. Notably, the world’s most established multinational companies, such as Emirates, Air France, Accor, and IHG, are among the Tier 1 partners of Qashio. Subsequently, the firm has achieved an 800% YoY rise for the third year in a row.

The success of the Dubai-based firm is just one of many examples highlighting the city’s appeal as a regional headquarters for international companies.

According to Lucidity Insights, start-ups across MENA raised about AED 1.89 billion in just April and May 2025, signalling increasing investor confidence. The UAE accounted for around AED 543 million of this funding across 23 deals, with Dubai serving as both a major source and recipient of venture capital. This highlights Dubai’s pivotal role in supporting start-ups and scaling them into globally competitive enterprises.

The UAE’s corporate ecosystem recorded over 5,600 new start-ups registered in Q2 2024 alone, fuelled by an integrated investment environment, flexible business policies, progressive legislation, and a diversified sectoral landscape. Statista data further underscores the UAE’s leadership, with over 550 fintech companies driving innovation and growth, reinforcing the country’s dominance within the regional business environment.

Dubai’s ecosystem value surpassed AED84.46 billion by the end of 2023, ranking it first in the Gulf and second in the MENA region globally. This growth is supported by key players such as In5, a TECOM Group subsidiary that has nurtured more than 1,000 startups since 2013 and helped raise AED 7.70 billion in funding. These figures underscore the emirate’s robust infrastructure, investor network, and government support.

Looking ahead, Dubai is expected to maintain its trajectory as a lucrative destination for start-ups and venture capital. The city’s ability to attract high-net-worth individuals, strategic investors, and multinational corporations will continue to accelerate its start-up ecosystem’s expansion. For entrepreneurs interested in building a business in Dubai or scaling an existing venture, the combination of capital availability, regulatory support, and sector diversity offers unparalleled opportunities.

Don’t forget to share this post!

We use cookies to enhance your experience on our website. If you continue using this website, we assume that you agree with these. Learn more.