⬇ PDF download: Dubai’s FDI hits record in 2024: How will this impact the financial sector?

The financial sector in Dubai remains attractive to international investors, as demonstrated by the Dubai Financial Market (DFM), where foreign investors made up 50% of the overall trading value in 2024. Notably, the city’s record achievements in greenfield FDI further demonstrate the rising global trust in its financial ecosystem. This undoubtedly enhances the prospects for foreign businesses looking to do business in Dubai.

This article is the first part of a series exploring Dubai’s upward trajectory in greenfield FDI, capital inflows, and job creation. It analyses how Dubai’s business-friendly ecosystem continues to drive economic expansion and attract top-tier global enterprises.

The UAE Cabinet has recently approved the National Investment Strategy 2031, which easily marks an important step in making the country a leading global investment hub. This strategy focuses on five main sectors: (1) industry, (2) financial services, (3) transport and logistics, (4) renewable energy, and (5) telecommunications. The goal is to increase foreign direct investment (FDI) stock to AED 2.2 trillion and raise annual inflows to AED 240 billion.

To support this, the strategy includes 12 new programs and 30 initiatives. These strategies include:

These efforts will boost investor confidence and simplify the process of starting a business in Dubai as well as in other emirates.

The newly approved policy directly supports Dubai’s rising greenfield FDI trend.

New records from fDi Markets — the cross-border greenfield FDI tracking database by the Financial Times — reveal that Dubai is leading the world in attracting FDI projects, with 1,117 ventures recorded in 2024. This growth represents a 33.2% YoY increase, totalling a capital of AED52.3 billion. In total, the city announced 1,826 FDI projects last year, spanning various investment types, including venture capital-backed FDI, reinvestment, mergers & acquisitions, and new forms of investment.

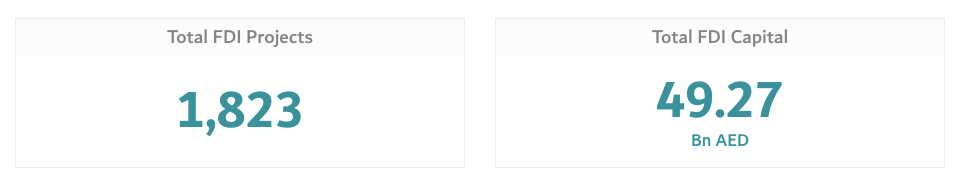

Source: Dubai FDI Monitor

Additionally, fresh data from the Dubai FDI Monitor — which observes, verifies, and reports on FDI flows into Dubai across key FDI metrics — shows the emirate’s total FDI projects in 2024 were at 1,823, valued at AED49.27 billion.

It is also worth noting that the emirate secured its place as the world’s top destination for FDI headquarters projects, welcoming 50 new headquarters last year. These developments further improve Dubai’s appeal to businesses wanting to efficiently set up a business in the region.

Dubai’s free zones, including the Dubai International Financial Centre (DIFC) and Dubai Multi Commodities Centre (DMCC), are vital in attracting global investors and helping businesses grow. Home to over 6,000 companies, DIFC saw a 24% increase in new firms in 2024, with fintech and innovation companies rising by 33%. Meanwhile, DMCC now contributes 15% of the emirate’s total FDI, having added 1,023 new companies in H1 2024 alone. It currently houses nearly 25,000 firms across its business district.

The strategic advantages these free zones carry, such as business-friendly rules and incentives for specific sectors, make Dubai a top destination for foreign companies and SMEs looking to expand. In fact, high-potential sectors, like technology, energy, and financial services, have gained immensely from free zone incentives — e.g., DMCC’s crypto and AI sectors have seen a rise in new companies.

Foreign investors are crucial to Dubai’s economic upsurge, and SMEs stand to gain significantly from the city’s investment-friendly policies. With constant government support, infrastructure development, and business incentives, Dubai remains a global leader in enabling entrepreneurship and bringing in long-term investments.

Don’t forget to share this post!

We use cookies to enhance your experience on our website. If you continue using this website, we assume that you agree with these. Learn more.